Home Affordability Calculator Usa

Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well. Most importantly it takes into account all of your monthly obligations to determine if.

Home Affordability Calculator For Excel

But like any estimate its based on some rounded numbers and rules of thumb.

Home affordability calculator usa. This is known as the 2836 rule. The home affordability calculator is designed to suggest a conservative sales price you can afford. You can find this by multiplying your income by 28 then dividing that by 100.

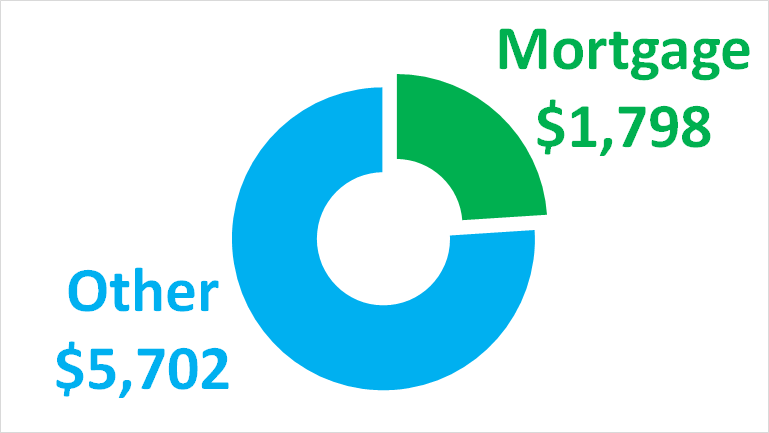

A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income. Mortgage Calculator Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. This home affordability calculator provides a simple answer to the question How much house can I afford.

Simply enter your monthly income expenses and expected interest rate to get your estimate. FHA Rates Near 50 Year Low. Check out the webs best free mortgage calculator to save money on your home loan today.

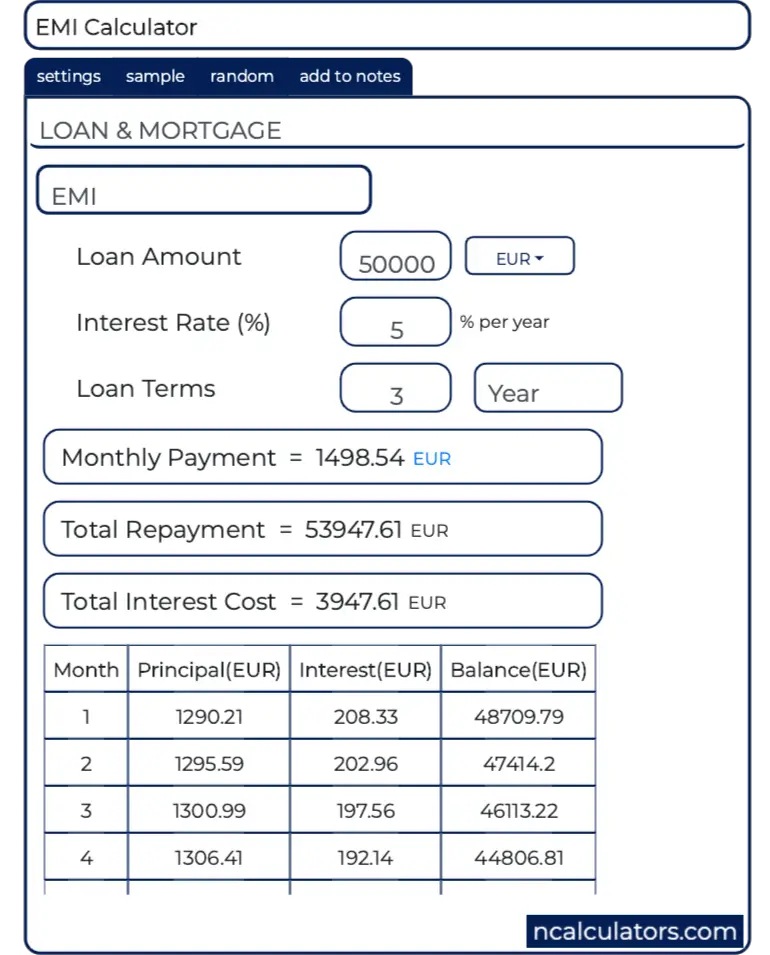

Or 2 Monthly Mortgage Payment based on your desired purchase price. Why do you need to know the ZIP code. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

FHA calculators let homebuyers and homeowners understand what they can afford to safely borrow to finance a home. Once you know the home price you can afford use our Mortgage Calculator to get an estimate of how much you could expect to pay monthly based on todays rates. The results will show your approximate monthly payment and help you decide whether you can afford that home you love.

First-time home buyer help. Plugging all of these relevant numbers into a home affordability calculator like the one above can help you determine the answer to how much home you can reasonably afford. Learn more about mortgages.

Affordability Guidelines While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes. Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like. 1 Maximum Purchase Price based on your desired monthly mortgage payment.

You can also use Rocket Mortgage to see what rate and monthly payment youre approved for. Census Bureau stated that the median price of a home in the United States was 321500 in 2019 while the average price was 383900. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

But beyond that youve got to think about your lifestyle such as how much money you. If you live in large metropolitan areas like New York San Francisco or Los Angeles you can expect to pay significantly more. Now is the time to drop the interest rate on your 30-year mortgage or refinance into a 15-year home loan.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Your maximum mortgage amount with the NACA Mortgage combines the purchase price and any rehab escrow which cannot exceed the conforming loan.

Your mortgage payment should be 28 or less. How does debt to income ratio impact affordability. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

The calculator below will give you an idea of the following. Our mortgage affordability calculator above can help determine a comfortable mortgage payment for you. Financial planners recommend spending no more than 36 on total debt including a mortgage payment and no more than 28 on mortgage payments each month.

Estimate how much home you can afford with our affordability calculator. The home affordability calculator will provide you with an appropriate price range based on your situation. A mortgage calculator will crunch the numbers for you including interest fees property tax and mortgage insurance.

This estimate will give you a brief overview of what you can afford when considering buying a house. Use Bank of Americas mortgage affordability calculator to help determine how much house you can comfortably afford. Our calculator includes amoritization tables bi-weekly savings estimates refinance info.

Enter your income expenses and debt to.

Home Affordability Calculator For Excel

How Much Home Can I Afford Mortgage Affordability Calculator Free Mortgage Calculator Mortgage Mortgage Payment Calculator

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Home Ownership Expense Calculator What Can You Afford

Free Mortgage Calculator Free Financial Tools Transunion

How Much House Can I Afford Bhhs Fox Roach

I Make 90 000 A Year How Much House Can I Afford Bundle

Income Needed To Afford The Average Home Price In Every State In 2018 Icast

How Much Mortgage Can I Afford Zillow

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

How Much House Can I Afford Forbes Advisor

Home Affordability Calculator Money

How Much House Can I Afford Rocket Mortgage

Mortgage Calculator Excel 9 Mortgage Payoff Calculator Calculate The Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Can I Afford To Buy A Home Mortgage Affordability Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Post a Comment for "Home Affordability Calculator Usa"