House Appraisal Below Purchase Price

Typically the appraisal comes in right around the sellers listing price but sometimes you wind up with a low appraisal. A seller might agree to accept 5000 in cash and lower the price by 5000 if the difference is 10000.

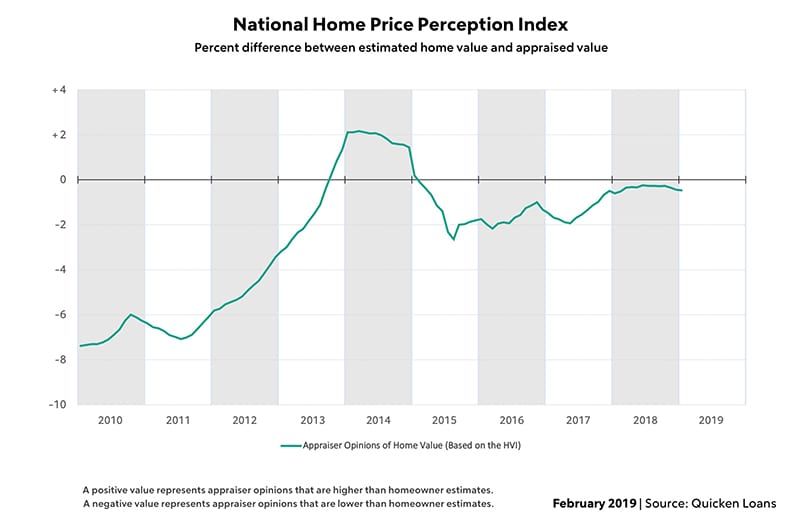

Inaccurate Property Values That Consumers Find Online Online Real Estate Real Estate Prices Real Estate

The appraisal came back at 1 million well below the 1165 million contract.

House appraisal below purchase price. For example assume 6000 in closing costs and pre-paids. When youre buying a home and are under contract the appraisal will be one of the first steps in the closing process. What To Do When House Appraisal is below Purchase Price Published on - 6192021 74737 PM In todays booming housing market sellers have their pick of home offers.

The home youd like to buy is appraised at 150000. Say the sales agreement for the house is 420000 but the appraisal came in at 410000. Using the purchase price of 200000 and the appraised value of 210000 the price could be renegotiated to 206000 with 6000 in seller paid closing costs.

Now more than ever sellers have a chance to get more money for their. The seller might reduce the price to 415000 so. Explain that you are not willing to pay more for a house than it is worth in the current market.

If the appraisal comes in at or above the contract price the transaction. The deal will likely go through barring any other snags. Lets use a 395000 value for this example.

Depending on the interest rate and possible PMI its likely that the monthly payment would increase 25 40 per month. The problem comes in when a buyer finds a property and negotiates for a price well below what the appraisal value should be but the appraiser looks at the purchase price and bases value just above the contract price. The final LTV is now 9875 380000 395000 and not the initial 95.

How is a house appraised. The notice shall be signed by the. When It Falls Below the Purchase Price If the appraiser determines that the home is worth at least as much as the purchase price theres no problem.

If an appraisal comes in below the sale price its likely due to one of these common causes. Low FHA Appraisal Below Purchase Price When the appraisal comes in below the asking price there are several things you can do. This means that the appraisal comes back below the price agreed upon by the seller and buyer under the contract.

Heres how to calculate your LTV. Every once in a while the parties to a transaction will agree on a sale price of a home and the appraisal comes back lower than that price. But when the appraisal comes in below the purchase price the buyer and seller are pushed into a corner.

You and the seller agree that youll buy the home for 150000. Youve contacted the appraiser see the end of this post but the data andor sales information you had didnt help your cause. This way your FHA lender will be willing to move forward with the loan.

In addition you tell your mortgage lender that youre making a down payment of 20000. I really fought the appraiser a lot and saw a lot of erroneous things on his appraisal she said. Property upgrades arent worth what the seller thought Stinson sees this as the main reason for an appraisal coming in below the contract price.

Subtract your down payment 20000 from the total selling price 150000. I understand that you are using the purchase price as a part of your appraisal. Sometimes sellers will back their price down to keep you from paying the entire difference between the sales price and the appraisal.

Or just tell them the house appraised below the agreed-upon purchase price. Lower the sale price to the appraised value. Appraised value is lower than the sales price bad The worst case scenario is when the appraisal comes in below the sales price of 400000.

If the property is appraised for loanpurposes for less than the purchase price stated herein the Buyer shall have the right to terminate this contract by written notice to the Seller or Sellers Broker delivered within 5 calendar days after Buyer receives a copy of the appraisal. Give them a copy of the appraisal report if you have one. The homeowner seller could reduce the selling price to match the appraised value.

The first thing you should do as a home buyer is put the ball back into the sellers court. They might settle somewhere between a full cash contribution and completely lowering the price.

All About Home Appraisals Lone Star Financing

9 Tips To A Higher Home Appraisal Home Appraisal Appraisal Refinance Appraisal

What Home Sellers Should Know About Appraisals In 2021 Home Buying Tips Home Appraisal Home Buying

My Home Appraisal Came In Too Low Now What

What Happens If My Appraisal Comes Back Under Contract Price Riverfront Appraisals

The Untold Truth Of Home Appraisals Real Estate Decoded

Appraisal Comes In High Or Too Low Ideal Lending Solutions

Roswell Ga Estate Qaurantinegoals Priced Under Appraised Value Don T Miss Out Estates Virtual Tour Things To Sell

My Home Appraisal Came In Too Low Now What

609 Granville St Oxford Nc Foreclosure Currentforeclosures Com Foreclosure Properties County Forecosures Foreclosed Homes Hud Homes Foreclosed Properties

Almost 100k Below Actual Appraisal Real Estate Selling House House Search

Home Appraisal What To Know About House Appraisals Home Appraisal Real Estate Tips Real Estate Advice

Pin By Elena On My Saves Mobile Home Parks Mobile Homes For Sale Park Models

Home Appraisal Home Appraisal Appraisal Mortgage

Is A Low Appraisal Good For The Buyer

Should Sellers Get An Appraisal Before Listing Here S Why It Ll Cost You

The Appraisal Came In Low Now What Zillow

My Home Appraisal Came In Too Low Now What

Ten Tips For High Value Home Appraisals Home Appraisal Home Selling Tips Appraisal

Post a Comment for "House Appraisal Below Purchase Price"